With a few exceptions (notably for members of the military stationed overseas), you had to be in a binding contract by April 30th as one of the criteria to qualify for the heavily promoted income tax credit that is available to some home buyers.

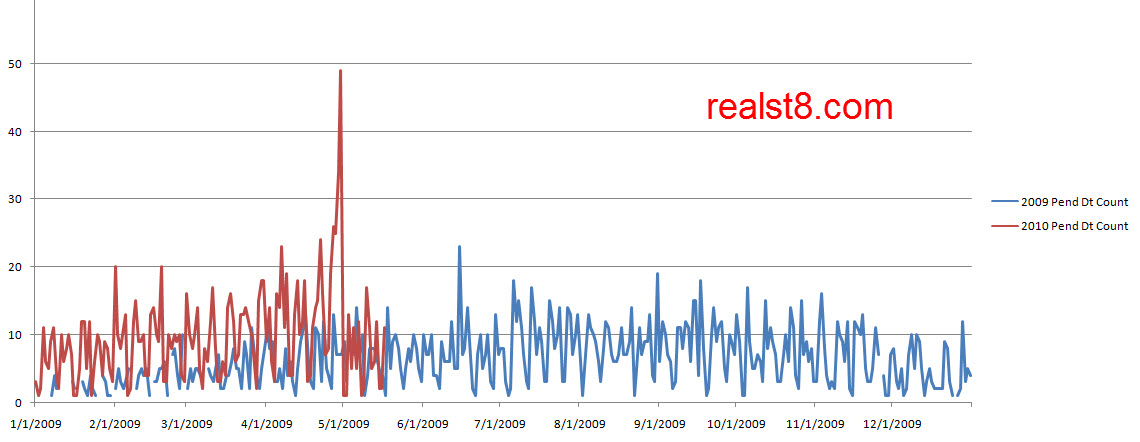

Personally and based upon my own conversations with people whose workflow is determined by the number of real estate transactions they touch (other real estate agents, title company closers, property inspectors and mortgage brokers), the tax credit increased the number of sales. But since I can’t talk to everyone involved with every sale, I checked the statistics too…the graph below charts the number of properties listed for sale in the South Bend Area MLS that went under contract each day in 2009 and through May 17th , 2010.

Notably, the pending counts for the first five months of 2010 are significantly higher than the same figures for 2009. And it would be hard to argue that the spike from mid April through the end of the that month is due to anything other than buyers who wanted to qualify for the tax credit.

Government involvement in the real estate market is hardly over now that sales don’t qualify for a tax credit:

- payments on mortgage interest remain tax deductible for most homes,

- Fannie Mae and Freddie Mac still buy large numbers of mortgages freeing banks to make more loans,

- and the FHA’s low downpayment loans have become a major player in market, accounting for about one in three of the pending or closed sales this year in the local MLS.

But the tax credit is over as one government driver of new sales. In our area, it commonly takes four to six weeks to go from binding contract to closed sale. And a provision of the tax credit requires sales to close by June 30th. Watch for the “tax credit sales” to close in June, creating high sales numbers for the month. After June, it’s more difficult to forecast. Sales will likely dip like car sales did after “Cash for Clunkers” ended. But changes in the broader economy, or in FHA policy or in how a large bank handles foreclosures could tip the scales of supply and demand in unexpected directions. Comments are open if you’d like to share your prediction.

I think the following info is very telling:

“Evidence of a slowing market was apparent Wednesday when the Mortgage Bankers Association released a weekly report on applications to purchase homes. Applications fell for the fourth-straight week to the lowest level since April 1997.”

Dean – I think we’ll see a sharp drop. The tax credit mostly affected lower priced properties and that is most of Michiana which has always been a low priced market. The credit is gone so new contracts will drop. I personally think the tax credit was a waste of time and money as it distorted the market even more at a time when we needed market stability, not tax games (fueled by fed govt debt). Oh well. There is always Canada! LOL (never in my life would I think I would look to Canada with such envy…)