The South Bend Area MLS records show that in July 2010:

- 213 residential properties were sold

- 267 residential properties went under contract

- 474 residential properties were newly listed or re-listed for sale (that is not a count of all homes for sale, just those listed in July. There are 2,563 homes listed for sale in the SB MLS as I write this)

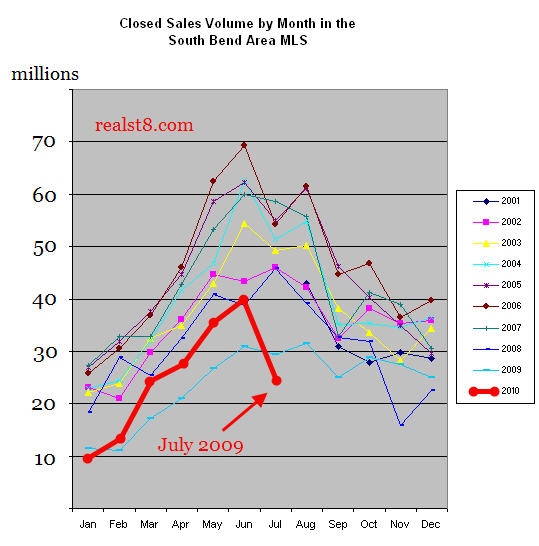

The 213 sales add up to $23.49 million in volume. That is about 42% less than June 2010 (the previous month) and about 20% less than July 2009 (one year ago).

Here is the long term graph

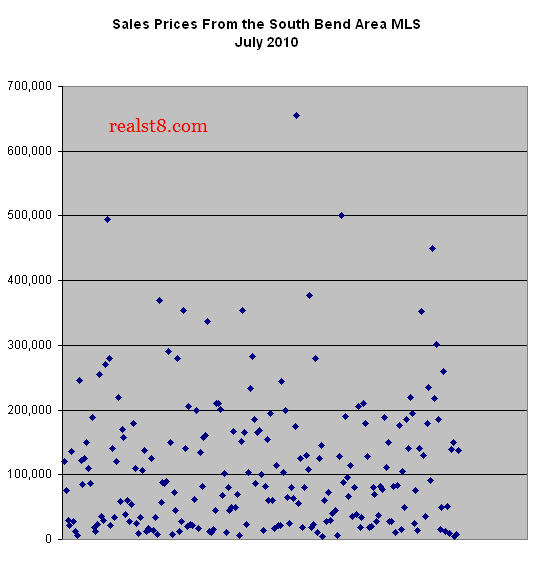

Real Estate Sales Prices

The high price sale was 51483 Megan Court in Granger’s Shamrock Hills. It sold for $655,000 on July 19th. It was listed for sale on July 17th, 2006 for $849,900, and was priced at $669,900 at the time of sale.

The most active high price neighborhood was Granger’s Covington Shores, which accounted for five of the ten most expensive sales in July:

- 51265 Amesbury Way at $500,000 on July 23rd.

- 51357 Carrigan Way at $494,000 on July 6th.

- 51276 Leeward Point at $370,000 on July 9th.

- 51223 Leeward Point at $353,500 on July 9th.

- 14236 Parkridge Drive at $353,000 on July 29th.

There were 19 sales that closed above $250,000 and 79 sales that closed under $50,000.

Here is every sales price for the month, at a glance:

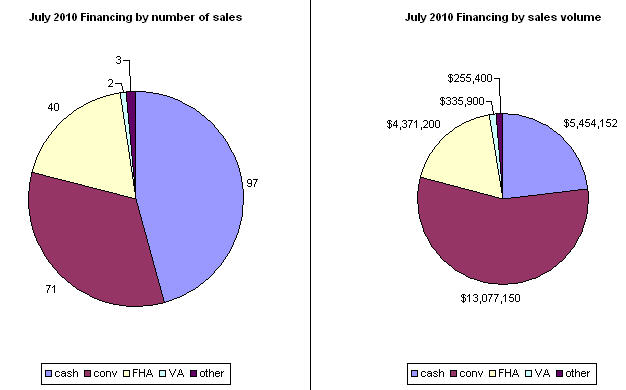

Financing

Cash sales led to the greatest number of sales, but conventional financing led to the greatest volume of sales. FHA loans were third by both counts,while VA and other types of financing accounted for a small number and volume of sales.

Notre Dame Condos

The Notre Dame condo market this month is almost completely inactive within the MLS. In the MLS, there were no Notre Dame condos reported sold, and only two went under contract:

- 2010 Bridgeview in New London Lakes, priced at $90,000

- 1428 Marigold #105 in the North Shore Club, priced at $61,600

But that does not mean the market is gone. There have been a number of new construction condos that sold directly from the developer to the purchaser, outside of the MLS which only reports sales that involved a Realtor. I have the deeds for two sales that occurred in July and for 15 that have already closed during the calendar year 2010 – all expensive, newly built condos or townhomes that don’t register in the MLS statistics.

I’ll write a useful summary of the Notre Dame condo market once I gather a few more pieces of data and take some time to compare it to years past. Until then, if you are in the Notre Dame condo market, it might be smart to find an advocate who is not affiliated with any specific project, but familiar with each of them. You might start with a quick e-mail to me.

New Construction

I found four new construction sales for July in the MLS:

- 18487 Summer Wind in South Bend’s Fernwood neighborhood: listed 6/3/2010 at $274,900 sold on 7/2 for $255,000. It was built by Alway Development Corp.

- 18090 Balston Circle in South Bend’s Georgetown North neighborhood: listed 5/14/2010 at $232,900 sold on 7/14 for $232,900. It was built by Bayman and Rusk.

- 1440 Slater Drive in South Bend’s Lafayette Falls subdivision: listed 10/27/2009 at $199,900 sold on 7/16 for $195,000 with $5,012 in seller concessions. It was built by Weiss Homes.

- 5636 N 300 E in LaPorte: sold unfinished and “as is” for $185,000. It was listed 3/9/2010 at $240,000.

More Questions?

If you are considering the purchase or sale of property in the South Bend – Mishawaka – Granger – Notre Dame Area and want a no-pressure, no-hassles consultation with the Realtors behind the South bend Area Real Estate Blog, please contact us. We’re friendly and candid and if we can’t help you, we can probably point you in the right direction.

Great….quick update Nick! Always helpful to know!

Will be interesting to see the ND condos that sold outside of the mls. Wish they would report through the mls which would improve some of the numbers a bit.

July really tanked….but that was expected with the end of the tax credits and all. I doubt the rest of the year will be anything much different from 2009. Will see I suppose.

While total sales were lower, it was great to see the sales diversity. It has been a while since we have seen that many sales over $300,000.

Very interesting! Could you send me the five (out of the ten) top priced home sales in July that were not in Covington Shores?

Thanks,

Bob Walsh

Bob: http://bit.ly/July2010TenMostExpensiveSales

I try to be realistic…never too optimistic and never too pessimistic. But things just seem pessimistic in the Michiana area real estate market.

Based on July’s unit sales numbers, the area has a 12 months supply of housing. And more is being built near ND. A 12 month supply is not good under any situation. In fact, it is downright terrible. I doubt the numbers will improve in August, etc. to bring the months supply much below 10 months.

I look at a couple of neighborhoods that I know have been stable for over a decade and see homes sitting on the market unsold even with VERY reasonable prices. That tells me something. I also look at the new construction around ND as an indication of the investment in real estate (most aren’t year round residents). I have seen Stadium Village with it’s last three units at $50K off for months with no movement, I look at Ivy Quad and scratch my head at the economics of that development (can’t be profitable in my opinion), I see stalled plans for ESC, etc. and can’t help but think the malaise in real estate is here to stay.

The demand is simply not there, certainly the investment demand is long gone but also the owner-occupied demand has dried up — partly because of the lack of enthusiasm that your home would also be an investment and partly due to lack of loan availability (need more $ down and higher credit score), and partly because of the ultimate housing indicator *incomes* aren’t expanding (real or nominal incomes).

It’s hard to be realistic and positive, but there is always hope.

Nick, Will there be an August report?

Yes. Shortly. Apologies for the delay.