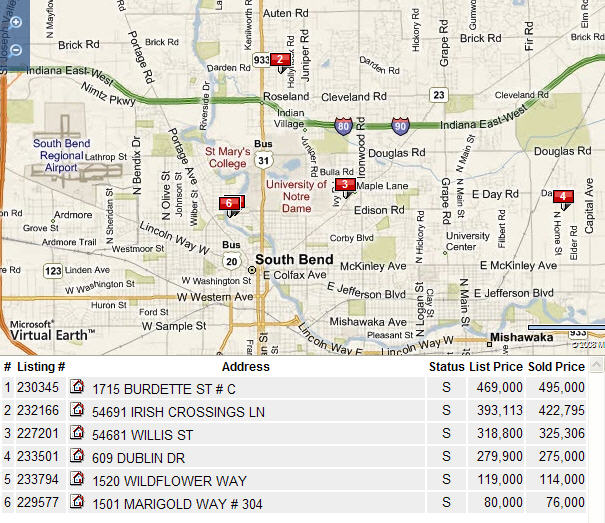

In the last 90 days however, I can only find 6 closed sales for condos or townhomes in St. Joseph County.

That is despite the fact there are at least 125 condos for sale this morning.

Below is a list of most major condo and townhouse communities in the area. Here’s your chance to comment on, or ask questions about any of these condos and get answers. Feel free to ask about any areas I left out as well. I’ll answer the questions I can. I’ve also invited a number of developers, residents and others with knowledge of the area’s condos to watch the thread and contribute. They may be able to answer the questions I can’t.

It’s an open forum, so say what you wish. Please be civil.Â

South Bend Condos

- American Trust Place

- Dublin Village

- Eddy Street Commons

- Irish Crossings

- Ivy Quad

- Jamison

- Keenan Court

- Northshore Club

- New London Lake

- North Douglas

- Oak Hill

- River Point

- Stadium Village

- Topsfield

- Wexford Place

- Woodbridge

Mishawaka Condos

- River Walk Townhomes

- Sedgewick House

- Stonebridge

- The Forest

- Townes at Kamm Island

Two things jump to mind first:

1. When oh when will developers learn that bulding more and more high priced condos is just dumb! I love living in the South Bend area and I’m a big advocate of all the things it has to offer. BUT I know we aren’t in New York or Chicago so the pool of buyers ready and willing to buy condos in the $300s plus is miniscule at best. Developers, get smart and build more decent quality condos in the low to mid $100s.

2. I still don’t get the Oak Hill desire. It reminds me of a run-down old apartment complex.

Many people argue that Oak Hill is overpriced, and it may be since there are 12 for sale now and none have sold in the last six months.

BUT

They (and to a lesser extent Jamison) are still the most affordable condos within a stone’s throw of Notre Dame. Real estate is worth what someone is willing to pay for it. It will be interesting to see if there are any buyers willing to pay the asking prices (mostly about $160k – $190k) this Spring. Or any sellers willing to settle for less. So far, neither side is budging.

admin note:

I’m moving three comments to this forum that were left on recent articles.

I’d be interested to hear your take on the new Ivy Quad “townhomes” project. I looked at their website and the floorplans and how the units stack is, well, odd. Any thoughts on this especially at those price points and how it competes with Eddy Street Commons? Are the same people behind Keenan Court townhomes too which is a nice project but in the wrong place at the wrong price since sales have never taken off in 18 months. Your thoughts?

David Mathews is the developer behind Ivy Quad. He was a partner at Keenan Court, but told me he parted ways from that project. I met him at the site of Ivy Quad during the excavation stage, but couldn’t get my mind around the nuances of the layout at that time. It seems to be somewhat variable based on what they sell. David, if you visit this forum, can you help us get a handle on your project?

The most interesting aspects of the project are the central green space / quad and the green aspects (It should be LEED certified). Though the location is slightly closer to Notre Dame’s campus than some of the other luxury condos, I don’t think a few hundred yards in either direcion will be a major selling point.

Whatever happened to Woodbridge Villas??? I really like them but thought they were a bit over priced and sorta crammed in there next to Ironwood Drive if you had one that backed onto it. I had heard the developer was going bankrupt or the bank was or had taken it over? I feel bad for the building since they are a nice builder.

I was wondering if there were any closings at Stadium Village Townhomes? Their website says some have sold. Also curious at what prices….

There is one sale at Stadium Village in the local MLS. It closed 2/6/09 for $495k, which I believe makes it the most expensive condo/townhouse sold in the area. There are three units listed for sale.

Is Eddy Street Commons going to sell well in this environment? What will be a real tell is how the commercial space leases out. It appears to be a nice project but probably will be sorta out of place as it will be a little concrete urban jungle in the middle of nowhere. Very little green space, tall buildings, a lot of concrete, so over planned that it looks artificial like a Disney World set. It has big ND backing which may help some of the residential sales, use of the hotels, but that won’t help retail sales in the retail stores which won’t be able to pay the light bill.

Tracy, I just want you to know that there are quality built, moderately priced townhomes in South Bend. Keenan Court Townhomes (http://www.keenancourt.com) has units starting in the $160’s.

See a virtual tour at: http://www.visualtour.com/show.asp?T=1806354&prt=10003

Enjoy maintenance free living at its best! Keenan Court is a maintenance free community embracing 30 private residences in ten, two story buildings. Three unique, versatile and open floor plans ranging from 1760 to 1830 square feet are available, each featuring 2.5 baths, two, three or four bedrooms, attached two car garages, cathedral ceilings and a wide variety of preconstruction options. The units are priced starting in the $160,000 range. All exterior maintenance, lawn care and snow removal will be provided by the Keenan Court Homeowner’s Association.

Keenan Court’s location is a major amenity, situated in the quiet and pleasant McKinley Terrace neighborhood. Near the Morris Park Country Club, Keenan Court is just 1.5 miles from the Notre Dame Campus, and less than five minutes from the Grape Road retail corridor.

Keenan Court are quite nice when you are inside. It’s too bad that they feel so far from Notre Dame. Great condos in South Bend are a little like beach homes – they cluster around one attraction. It’s easy to make a logical case for a nice condo pretty close to Notre Dame, or a few blocks from the beach. But those properties lack the emotional punch of of a place where you don’ t need a car to get to campus, or you can look out and see the water. It’s that emotional reaction that gets people to reach into their wallet. Without it, you need to appeal to people logically – a much harder sell.

Nick, while I agree that a 1 mile radius seems to be the magic number for ND buyers, Keenan Court has drawn local, young professionals and “snow birds” for the Sunnymeade area. Forrest Beach Builders is introducing a first floor master plan to address the needs of the more mature buyers.

I would differ somewhat on your description that the South Bend condo market is a bubble market.

In a real estate bubble, or in any other market bubble (like crude oil last summer) , speculators act on a macroeconomic basis that increases values above a rational cost of production and normal demand values. When the bubble bursts, prices drop back to a value that represents the true, historic value of the asset being sold. Note the swing in Florida condo’s, copper, wheat, and crude oil prices in the last 24 months.

In FL, speculators bid up the price of housing units, to avoid being left out of the market with the plan on flipping the unit to the next buyer who also saw similar resale profit opportunities. The price of units being sold had no real value against the “historic†value of the land and construction costs involved in the unit being sold.

That is not the case in South Bend.

While I do believe that there is some short-term danger of over supply in South Bends’ condo market, I believe that offering prices on new construction accurately reflect the cost of construction and land. Land adjacent to ND is like beach front property. The closer to the beach, the higher the land cost. Land that has gone into projects adjacent to ND like Stadium Village and Irish Crossings was sold to the developers at prices that accurately represent a fair marginal utility valuation for the land.

Land where the Keenan Court project is located has much less value, which is accurately reflected in the offering price of the individual units. You can’t walk to ND from Keenan Court. You won’t pay a premium for buying there. And yet with a price 50% less than the upscale projects, they’ve not sold many units.

On the other hand, during Florida wackiness, prices for condo’s prices were not based upon any sort of normal supply/demand cost structure.

Irish Crossings and Stadium Village Units also have significant amounts of standard, base-price upscale amenities. This would include upgrades in kitchens, flooring, brick exteriors, cabinets and granite. These upgrades would easily add $50,000 in cost to each unit. Couple these costly amenities with costly “beach front†property, and you have $300,000+ condo’s.

People complaining about these high prices don’t understand the market.

Eddy Street Commons, Irish Crossings and Stadium Place are not for the normal South Bend/St. Joe County buyer. These buyers can get a similar product for less in corn field developments built ten miles from ND, where land costs are less.

You can also by a home 10 miles from the Lake Michigan shoreline for significantly less than a home on the its’ beach.

Eddy Street Commons, Irish Crossings and Stadium Place buyers are high-networth buyers, who expect the upscale items offer as standard features, and additional pricey upscale options. And most importantly- they want to be adjacent to ND. These buyers VALUE these developments’ proximity to ND, realize that land next to ND is scarce, and are willing to pay what the market will bear to be walking distance from ND.

They don’t want a condo, at any price, that’s not adjacent to ND.

People who want $100,000 condos next to ND don’t understand economic supply and demand or how development works.

Dog patch,

I agree with you on the marginal utility of land adjacent to ND. My argument stems from the fact that the strong demand was not there to build these condos in the mid 90’s when I was at ND and only in the run up of the last few years has construction reached this epic pace. Where will demand go as we deleverage? The ability for any of these so called “high net worth” buyers to materialize and either pay cash or finance any of these apartments is very quickly dwindling due to overall market dropping in every way. True demand is a fickle beast. Is there really this much demand for $300-$400K apartments next to ND. Are there really that many more ND grads or sub alums that have to have a place next to ND? I would argue that nothing has changed from when I was there in ’96 other than the easy access to leverage to finance the purchase and building of these condo projects. That leverage is basically gone now and will not be back for a long, long time. No one in their right mind would ever buy a condo priced at these levels for a second or third home in a town with no internal means to support real estate at these levels. It makes no sense right now given all that has happened in the market and will continue to play out over the next two years. The price the land was purchased for as well as the construction costs are basically meaningless. The only thing that matters is the buyer’s ability to pay. As buyers lose the ability/willingness to pay these higher prices (let alone get loans at these levels) the prices will come down. I am in the market for a condo close to the stadium and have been looking for years. I missed the boat on the $80K Oak Hill condos but until this whole situation plays out there is no way I would ever touch some of these places at the current pricing level. Basically the prices paid for these land parcels by the builders were too much. The cost of the materials used to build condos are dropping like stones in a pool right now. When a bunch of these come online the market will have moved way past their ability to earn a profit. The days of a starbucks being guaranteed to come into a commercial development and pay $50+psf is over. This area will move back to where it was 10 years ago and may even move past that based on what I have seen lately. This is going to get interesting to say the least.

Mike NJ –

I agree with several of your points, but have found the Notre Dame market includes a surprisingly deep pool of high net worth individuals interested in owning property near the university. In my experience they are not fools, and don’t overpay unwittingly, but some are comfortable paying a premium to own nice, new/er condos very near Notre Dame or St. Mary’s, for themselves or their children. If that will remain the case as real estate becomes a less fashionable purchase and the broader economic turmoil impacts people of every income is anyone’s guess. If they completely lose interest in these condos, values will plummet as few local buyers will pay the “ND Premium,” but I haven’t yet seen this to be the case. Interest has dried up in the more exotic properties, like condo-hotels, but so far people still want to live in or have access to high-end townhomes and condos near the schools – even if most of the calls I’ve received in the last few months are people looking to rent rather than buy.

A few comments:

(1) I like Keenan Court, the floorplans are nice and the location is decent from a proximity standpoint but not from a neighborhood one where you are next to huge Section 8 rentals and homes sell well below $100K….as such it is out of place and the reliance on being near the country club is nonsensical since you really can’s see it. David Matthews may not be officially part of the KC project anymore but the team really consisted of David and his father, now it looks like just his father with David living about a block away. Why the odd statement that he “parted ways”….does he not help out his dad being a block away? The reason the project has failed is that you are offering townhomes in the $160K-$200K range next to **** ….. rule in real estate is to never over improve for the neighborhood and unlike the Notre Dame properties that are basically “beach front” properties, the KC area is not going to be undergoing a whole area renovation anytime in the next 50 years. Why spend $160K-$200K when you can easily buy a single family home in the SB area instead? I like the floorplans but no basement for storage was not smart esp with the garages not being over generous esp the middle units. KC was marketed toward ND people which was silly esp when Stadium Club couldn’t make a go of it being so close to campus (I could tell you a LOT about that white elephant later). The marketing of KC was weird at first with some sort of “voodoo” spot in the back (OK, I am being funny with that, but an outdoor chapel area in the woods seemed more like an appeal to Wiccins then college aged Catholics) and was then marketed to ND people as rental income properties which made SB buyers go bye bye since who wants to live among that? Now it is morphed into senior living???? Odd, it is two stories which is not senior friendly and no storage which old people need. This project failed and it is hard to understand what will start it back up. I wish them well but to make it work they need a spacious product under $100K.

(2) Ivy Quad….nice piece of property for sure…..they overpaid for it as it went into a bit of a bidding situation and the winner will end up being the loser as again (lesson, never get in a bidding war for anything), like KC, the marketing is odd…..not defined in the floorplans that can be anything from $250K flat to jumbo combined unit for probably over $800K. Too late to the party when sooo many projects are online at the same time. The whole “green” marketing along with a Segway is just plain STUPID, and I mean that in a critically helpful way…..so being blunt is all I can do. No one cares esp in those price points…..think about, how “green” is a buyer who wants a half million dollar home to use 4-10 times a year? No one cares! And the green space? I have seen the layout, one little strip of green lawn sandwiched in between the center, the rest is built on and paved over…..hardly green at all. What do you expect when you cram nearly 24, yes 24, units per acre??? My goodness that is a lot when you consider Irish Crossings across the street is only around 8 units per acre. The project is just too dense for the area without being more floors in a highrise type building. The floorplans are just odd… have a townhome with STACKED units….kinda defeats the townhome concept. Besides the floorplan and density fiascos, the buildout is a loser. Why? if they build in the order of the building numbers on their website, the are building the least desirable building locations first….building the middle units first (already under construction) then according to the building numbers the units along Burdette. Why is that a mistake. If I were buying in IQ I would wait for the units along the former Ivy Road which are the best locations. So, as a buyer, if I came in, toured the model, liked it and then looked at the project layout, any emotional buy to “buy now”…the urgency needed to sign on the dotted line….is gone as I realize I want the better building location. Better to build the better location first to start up the sales velocity and establish the project as a winner, instead, buyers will wait. Seems like there is little IQ at IQ…….even with David Matthews not parting ways with it yet. I wish them well, this project has potential but for the price point, density, odder floorplans/layout, it will be a struggle as Mike NJ has pointed out…..the enthusiasm for owning extra homes has dried up.

(3) Eddy Street Commons will be a struggle. Does the area really need more strip malls even if you stack residences and offices atop retail? The problem is the prices for purchase and rent will be in the higher range for this area….will the market support it? At this point in our country’s economic restructuring…and one where money is being spent in federal socialist way….do you really want to own a flat or condo in large buildings esp above retail? Who covers the assessments when the retail goes bust or only half the condos are sold? These things can be an economic nightmare. I prefer single family homes….and some townhomes with deeded lots….in this economic environment.

(4) Where I disagree with Mike NJ is that in the mid run, the property bordering ND have staying value. ND has enormous investments in its campus facilities and more or less will survive in most economies. Large parcels of land next to ND are almost nonexistent since ND has undertaken a strategy of taking out bits of land around it to prevent development of large projects…..and in the meantime destroying neighborhoods driving down prices so they can buy them up cheaper in the future (they complained about holdouts during their roads project but then they turn around and are the ultimate holdouts to totally prevent other development…..hypocrites eh? What’s new at ND.). The bigger threat to property values near campuses isn’t the broader economy, it is the premise of location based learning that is being undermined through the Internet. I haven’t read this anywhere, but it is a simple observation. Throughout history, centers of learning were based on books. These books were of limited supply as they were hand copied by scribes. Even after the printing press was invented books were still limited through cost. The CENTER of a university was its library and its book collection. People traveled great distances to learn from and read these books. Even today, limited copies of some texts and other documents are housed in monasteries and people visit to read them and do research. Well, with free unlimited copies of everything coming soon on the Internet, coupled with cheap video recordings of lectures, lessons, and labs, location based learning is nothing more than a social club. No longer is access to education limited physically with only X number of books and seats available. Why pay $160K+ for four years at ND when you could learn the same stuff for $10K? Quite frankly, the quality of education instruction at ND (actual classroom instruction) is nothing spectacular despite their constant praise of themselves. ND and other institutions of higher learning have been insulated in this global economy as the degrees they imparted where not subject to the global economy in a truly competitive way….that has started to change as things like engineering and architectural services have been going overseas as these overseas highly educated but low salary workers can work on a project without having to be in the US. Accounting and bookkeeping have been also been migrating to lower cost areas. Our prized high salaries for college degrees is the next phase as globalization hits in this wave of structural supply investment change on a massive scale. The macro economics of the cost of an ND degree ….. or any of these high priced colleges that have built physical palaces to themselves complete with private corporate jet(s) ….. will cause hesitation to spend that amount of money. Even now, people don’t want to spend that money on campus housing since the ND experience…..while the residence halls are great, the rules and restrictions are getting silly…. is going the way of boarding schools. You can’t fight the macro economics and in the long term, there will be little need for an ND palace in the snow with or without a competitive football team. As we enter the era of Weis 5.0 let’s hope further calamity doesn’t drive away all interest in ND football housing….esp since 2.0, 3.0, and 4.0 were big fat disasters….and an embarrassment to all ND alums.

Why is this not posting???

Mike,

I understand your point, but also have to disagree. Parents/alums buy the condos as an in-town to visit a child, for football weekends, or a future place to retire. Local people are not buying these units, which has surprised me. The most common buyer at Irish Crossings do appear to be parents who buy the unit as a place for a child to live while in school and the parent can use a bedroom while visiting.

You speak like a typical out of town alum who bashes South Bend as a hick town with “townies”. I invite you to drive around Granger and see the successful doctors, lawyers, professors, consultants and other business people living out there. I also recommend that you visit Heritage Square as well as Toscana Park.

http://www.shopheritagesquare.com/

http://www.toscana-park.com/

http://www.innovationparknd.com/

http://holladayproperties.com/mixeduse/mixeduse_property.php?propid=AMPSB

In my mind, the biggest risk to the developments is not a lack of interest, but it is the layout. The gentleman from Keenan Court hit on this above. Retirees do not want to travel up and down 3 levels of stairs, which all of these buildings have. Retirees want to be near education and have the chance to take a class or two. Notre Dame would be well served to start offering a couple classes a semester specifically for retirees because it would bring them and their disposable income to South Bend. (I am not a retiree…..in my late 20’s). Pendlewood Villas have a great layout for retirees on one level and are built extremely well in my humble opinion.

For young people, Eddy Commons will be a success if they developer gets the pricing right. The ability to live, work, and dine model has been proven around the country. It will work here if all of the rates (office, retail and residential) get closer to local market levels. The apartments were smart because they will immediately bring traffic to the development and a feeling of activity.

In economies like this, people will revert to their comfort zone. You will be hard pressed to find an alumnus who would not love to relive their college years. The developments around Notre Dame and other colleges/universities will continue to be a success.

I cannot conclude without mentioning that football is a linchpin for Notre Dame. The success/failure of the football team has a huge impact on everyone in South Bend from developers to hotels to restaurants. We do not have so many hotels in South Bend because of mountain or ocean views!

JL

Also, all of this can be had at a fraction of the taxes most people pay around the country. Taxes on my condo in South Bend are $700 for 1,200 sqft. I have a one bredroom condo in Chicago with 685 sqft and my taxes are $3,600.

The city also announced a plan to spend $12 million on our airport so that it does not look like an airport in a 3rd world country (said by a recruiter at ND once and I will always remember this because it was so strange).

http://www.usatoday.com/travel/flights/item.aspx?type=blog&ak=61921768.blog

I would respectfully differ with a couple of Mike NJ’s comments:

1. Quote: “No one in their right mind would ever buy a condo priced at these levels for a second or third home in a town with no internal means to support real estate at these levels.”

People who buy townhomes in the area are often buying because of an emotional attachment to ND. The same reason they buy on the Marco Island in FL, at Aspen or Vail, or in Augusta, GA. There are numerous seasonal or second homes in these locations, at prices significantly higher than around ND. I know many people who own homes in these locations, and I don’t consider them nutty. I do consider them wealthy though, and they didn’t get there being stupid. (I’m not talking about speculators) When you use the term “right mind” I’m not sure your truly understand the motivations of the ND market buyer. They want to be walking distance to ND, especially on football weekends, and are willing to pay for that privilage just like someone pays be at the at the foot of the Vail ski slopes.

2. Quote: “The cost of the materials used to build condos are dropping like stones in a pool right now. ”

Please tell me what materials used in contruction are “dropping like stones right now”?

I’d like to meet these suppliers.

While price increases for a lumber have moderated, prices for siding, roofing, brick, flooring, appliances, and HVAC components have all taken price increases in the last 12 months. Roof shingles for example have gone from $45 to $82 a square in a year. Remember the 1.5 million roofs that needed replacing in Texas after the last hurricane? Same supply, big increase in demand. To keep prices up, manufactuers have taken production off-line at facilities like sawmills and drywall plants.

Remember your econ 101? Reduced supply in times of falling demand will cause prices to remain somewhat constant. That’s what’s happening with construction pricing. There are not excess amounts of building materials stitting around in the supply chain. Manfr’s are keep a tight leash on supply, to avoid situation where they have to cut prices to move inventory. While labor is costs are flat, everything else is going up. And labor represents a small portion of construction cost.

If you look around the country, the areas suffering decline in pricing are areas where the was a speculative bubble in real estate. There were numerous developments being build before buyers exisited. I not sure that is the case in the South Bend Condo market. If demand slows, I believe you will see contruction slow.

In most cases around the country, the “good stuff” i.e. places in desirable locations like on the ocean, have not suffered from price deflation. Look at what’s selling in the South Bend area right now- it’s not corn field locations. It’s condos adjacent to ND……the “good stuff”.

You can buy a lot of cheap stuff in FL right now too……however, it’s not on the beach. You can buy cheap stuff in South Bend too…..but it will be a long walk to ND…….

Nick,

The http://www.IvyQuad.com website went through some extensive upgrades about a week or so ago. There is now a diagram, which shows how the floors / condos go together. Check out:

http://www.ivyquad.com/floor_plans

We are working on a better way to display this, but for the time being, this is what we have. There is also an open house this weekend (2/21 & 2/22), Saturday and Sunday from 12-5, showing off the current construction. As part of our LEED certification processes, we will hold open houses for the public to learn about how Ivy Quad is built “Green.” March’s inMichiana magazine also featured a story about Ivy Quad and the Green initiative (http://www.ivyquad.com/pdfs/inMichiana-March2009-IvyQuad.pdf ).

I really like the blog / forum idea. Great work,

David Matthews

http://www.IvyQuad.com

Good luck with the open house and the project DM. I wish I was in town this weekend to see the project but needed to get some sun and am in for lunch right now. Good location. I think your project will be telling of the future for developments around ND and also Eddy Street Commons as it rolls out over the next few years. I have to reiterate that I don’t think the “green” thing sells units…..didn’t work for downtown Chicago at several developments I’ve looked at and the SB area hardly has such urban concerns. But who knows, I could be wrong…..will be interesting. It makes for nice conversation but having a better touch and feel experience gives you more bang for the buck. FYI, who would be caught dead riding a Segway on campus??? A golf cart is fun, a Segway is nerdy and sooo not ND. You’ve got a density and parking challenge that will need to be addressed.

With respect to who buys these higher priced luxury townhomes and condos, I am surprised more ND profs don’t buy them if they are empty nesters…..walk to work from new construction instead of the hodgepodge of Harter Heights. Pendle Woods has been really really slow….albeit nice floorplans and quality built (toll road noise is its weakest point) but the place is a ghost town….seriously, very very few year round residents. Drive through there and see for yourself….resales have proven difficult too. Football is the “communion table” at ND….without it, it wouldn’t be the same school…even though the current students don’t have the fire in the belly over football anymore. There is a lot riding on Weis and I for one am utterly amazed at how ND has screwed up since Holtz’s last year…..utterly screwed up. BD wasn’t terrible but he wasn’t the man and after his renewal then quick departure everything quickly went down hill. At this point, ND is playing catch up while others are still pulling farther ahead. It is sad really but it is what it is. My opinion is Weis is the wrong guy to lead anymore and people are afraid to admit it since it really would really be an admission of ND as a “has been” football program relegated to a second or third tier program forever. Denial is a powerful brain function I suppose…and pride is dangerous. But reality can’t be denied in the long run and 20 years is getting a bit long. The retirees will find that ND doesn’t have much for them….Holy Cross College across the street at least reaches out to them (even if they don’t get the property tax break …. nice try though Brothers! Can’t blame you though even if your arguments had zero cred). The performing arts building and program at ND has failed as a cultural center to our area….a big failure where even the heavily recruited top guy left after a short tenure. The ND admin has run that into the ground like the football program.

The ND Admin also has the problem of being schizophrenic and with its current weak president the direction has been wobbly at best. Oh well, at least they still have billions in the endowment…I hope. College housing projects were a more recent development and were the project of the overall housing bubble and retiring wealthy college alum baby boomers. Fortunately, like beach front and other destination oriented developments, such college housing projects, overall, will fare better than former cornfield subdivisions 25 minute drive from work…or 2 hours for the Cali people. But, retirement funds are down down down if they had significant exposure to stocks and the enthusiasm for holding a second, third, etc. home is way way down too as the holding costs now exceed any expected price appreciation. The little money down for the rarely used appreciating vacation home are gone.

Interesting that ND has now rethought their dog patch strategy again…… schizophrenic. They wanted nice homes built, now they don’t. They didn’t before. Back and forth, back and forth. I bet they wished they had a reversion clause when they deeded that farmland area to Mr. and Mrs. Vaness all those years ago….. When is the next campus master plan due out??? LOL

What does all this mean for ND related real estate? It means the boom is over but there is still demand….we will find out how much demand over the next 10 months. I for one will stay tuned….

Anon Alum,

Your logic on libraries might make sense for second and third tier schools. That said, there is a whole lot more to learning than books. From clubs, to team meetings, to career fairs, to professor quality, to presentations using the latest techology, to habit building items (house cleaning, cooking, etc), there is a lot to be learned at school. If tier 1 schools do start to start to offer more online learning, this will hurt the brand.

The developments around ND will utlimately be successful. Real Estate is not the only industry to feel the pitch of this economy. Watch for people to start “down sizing” to developments around ND as baby boomers try to get away from outdoor maintenace and larger homes.

Also, you cannot forget Holy Cross Village as a competitor for buyers in this whole process.

http://www.holycrossvillage.com/

Also, I should have mentioned the price difference regarding the tax item. My 2 bedroom in South Bend was 1/3 as expensive as my 1 bedroom in Chicago.

I’m not sure how ‘green’ a home is when it is a minimum of 1400 s.f. then 2700 s.f., 4100 s.f. – 5500 s.f. and building on what was nice open green space versus a brown field. There is more to ‘green’ then simply what materials you use or adding an inch of insulation, it means consuming less overall.

JL – you wrote “Your logic on libraries might make sense for second and third tier schools…..”

– Well, you can learn the same things regarding how to clean your room, cook, etc. at a state school for 80% less….. or with roommates as you learn via the Internet services and work part time. By the time you reach college, the need for kindergarten are over and ND has a long long history of being a bubble reality (yes, I know laundry service is now optional for men and women) and not the “real world”. Online learning is here and nothing will stop it. ND even does this in exec MBA, etc. Anyway, the college world will change in 10 years without the need to be in one place to learn….and you can simply join a local sports club too. Think about it. There is nothing that special about tier one schools except perhaps the graduate programs which is NOT ND’s strength. Changes are a comin’ and many tier one schools simply invested too much in their campuses….how much admin s.f. does ND really need? Remember Flanner and Grace as residence halls and are now 22 floors of offices?

JL – you wrote “The developments around ND will utlimately be successful”

– Under whose definition? Will they be profitable? Some won’t be. Just look at Keenan Court and North Douglas Condos (which should have stuck with their original plan as apartments). Eddy Street Commons is still an open question (will proceed slower then expected and did have a late start due to financing…Kite ain’t that big) and Ivy Quad I have concerns about even with the Schwartz’ big money backing in the line of credit mortgage recorded in the county recorder’s office. Moreover, why would any baby boomer want to downsize to South Bend? That is a joke. The ND market is a vacation home market with almost no one retiring there even at Holy Cross Village where the out of town owners used it as football weekend home, not a retirement home (townies use HCV as retirement home, not out of town Domers). This is one reason why the real estate property tax issue flopped for HCV. A HNWI retiree isn’t gonna choose South Bend as a retirement place. Elkhart is the new Gary and South Bend isn’t too far away I’m afraid. Could be worse, Padre Sorin could have headed north and ND would be in Detroit!

If Padre Eddy did head north, would the name be Notre Dame du Grand Lac? LOL

My french isn’t too good. 3 semesters of foreign language at ND was pretty lame….would have been better and cheaper to use Rosetta Stone instead! Times are changing for sure….

Looks like there is a new high price offering for the Notre Dame condos.

Kite has opened reservations for another batch of condos at Eddy Commons: The “Traditions Residences” on the 7-9th floor of the Mariott Hotel.

The most posh? A 9th floor 2,214 square foot space for $1,523,475.

Quoted delivery? 2010.

Anon Alum,

You represent what is wrong with this country right now. Why cheer as the country comes unglued? Does it make you feel better to call Elkhart, a city that has made a substantial contribution to this country, the next Gary because banks no longer offer RV loans, gas prices spiked last year and people are losing jobs so they cannot afford an RV? Always remember to be kind to those on your way up because you never know when you will see them on your way down.

Regarding facilities, you miss the fact that most schools own all their buildings and alums would be happy to engage in sale lease backs. Regarding the books and school tier issue, I see inability to afford college as a more likely reason for people to stop applying to top tier schools. Parents will not be able to afford to send their kids to a top school, which is why most schools are starting to dig into their endowment and use it to help subsidize tuition. There is a potential solution and potential problem for everything. I tend to focus on the solution.

Anon Alum,

I have attached an op ed piece that gives a different persective of Elkhart. You seem to lack true perspective, and under estimate the American worker and capitalism at its best.

My view: Robert E. Letherman

http://www.indystar.com/article/20090211/OPINION01/902110321/1031

A different perspective about Elkhart’s economy

Posted: February 11, 2009

While I respect and support the office of the presidency, I must take issue with President Barack Obama’s misrepresentation of our community.

While Elkhart is suffering from a difficult economic cycle (not our first), our community is resilient. What he failed to mentioned is that we are, and have been, a barometer for the national economy. We have stared down and fought through many economic difficulties in the past. As producers of durable luxury goods (recreational vehicles, marine vehicles, specialty trailers, etc.), we face economic downturns and up-turns six months ahead of the rest of the country. Elkhart is a community of entrepreneurs that thrives on the motivation of capitalism, the creation of wealth and the responsibility of taking care of our friends and neighbors.

Our community has 22 banks and 122,000 residents. This illustrates the dynamic model of pure capitalism that, if left uninterrupted by large government intervention, would employ and justly pay those who choose to work hard when credit is once again available. We are a community of producers and innovators. A community of hardworking people. We are entrepreneurs who love the tradition of American business.

If President Obama had taken the initiative to spend one hour with the businessmen of Elkhart, he would have quickly gained insight regarding the resurrection of the economy. Elkhart is one of the last bastions of capitalism. Let us produce.

. Letherman is vice president of Northland Corp.

I think people got a bit out whack on my Elkhart comment….well at least it isn’t Detroit….thankfully Detroit people don’t read this blog! LOL

I wasn’t hating on Elkhart, I am being blunt. 20% unemployment is not out of the question there and crime has started to accelerate with even EMT’s getting bullet proof vests on the side. So many people have their heads buried in the sand that to continue to do so is harmful since people need to make plans based on reality, not wishful thinking. The consumer credit bubble will not get reflated and as my buddy Meredith Whitney so bluntly points out, US banks are projected to cut $2 Trillion in consumer credit card limits (closed inactive accounts, reduce limits) in 2009 alone. Even AmEx is offering $300 for people to CLOSE their AmEx card account (and hopefully induce paying off most or all of the balance!). We just went through a multi decade credit expansion that culminated in deceptive securitization of the principal repayment obligation while the credit transaction fees drove earnings and passed on the principal repayment obligation to chumps. The structural supply investment changes will take another 8 years to adjust and our shorter term supply slack burnoff will take 1-5 years depending on the supply category…..housing slack will take years, autos maybe 2, apparel 1, etc.

JL – Why is ND and other tier one campus palaces sooo expensive? The physical plant is one reason. You cite that the schools own the buildings (or at least most do) so why is a cramped dorm room that you share with roommates significantly more money then off campus housing where the owner not only has to pay property taxes but also has to make a return on investment? ND doesn’t pay taxes and their buildings were donated! Endowments are down 30% across the board (maybe 40% now)……the high cost of education at tier one schools is purely a matter of pride and arrogance, not ability to impart knowledge. Two decades of “status” education and building “lifestyle” campuses full of amenities is coming to a close. The debt burden ND and other schools have imposed on its students is shameful, and in my view unethical. It is no different then pushing $250 sneakers on people in Section 8 housing on foodstamps. Those are businesses I choose not to invest in.

I am not cheering any demise except perhaps the waste and arrogance that only stupidity brings.

If you think my bluntness is happiness, you are mistaken. I just tell it like it is….or at least the way I see it!!! LOL

HEY there ND fans, anyone looking for a condo is missing a great opportunity at Stonebridge in Mishawaka. We got ours last year after seaching the area for quite a while. What we like is being about 5-10 minutes as a straight shot down Edison to campus. We don’t have to live on campus to enjoy all the activities. The location is also nice because we have all the stores and restaurants close by and the area is much newer than the South Bend area. At the development we like the single story plans and the fact that we have access to a club house and pool if needed. We are also very close to several golf courses and again if you want to get to ND you are better off being on the east side for easy access.

Buck Allen – Fill in the details please. When did you buy, what price, s.f. and the like. I’d be interested to hear. I was in the loop on it way before they even got the land and really didn’t know how it would fit into the local market at those prices amidst an office park. Never followed up on how sales went. Looks like after 4 years they are still on phase one……how many units in phase one and how many have closed??? That will tell a lot about it. The floorplans looked nice and seemed more like “patio” homes and not really primary residences (again, storage space for the old people….need basements but I think there was a water table issue anyway)…..the company behind it was solid with experience in this kind of product so I defer to their “expertise” (in quotes since everyone was a real estate genius during the bubble…even my dog groomer)……

JL – I would also point out another failed project that actually got started…..Woodbridge Villas. Birkey Homes builds a nice product…not the most price competitive but not overpriced really either. The development crashed and probably was more the fault of the developer then Birkey Homes. Last I heard fire sale price for the rest of the development/lots. Might have made it all the way to the bank taking over…..too lazy to follow up since I predicted its crash before the concrete was poured.

Maybe you can check with the developer for details. I can only tell you I like it and recommend anyone with any interest go look for themselves.

The lender should have protected the developer of Woodbridge Villas from his/her entrepreneurial spirit. That land would have been best used as a build to suite professional office space because of the Ironwood and Toll Road visibility.

I like the Townes at Kamn Island in Mishawaka. They need more services in downtown Mishawaka to make that take off. It is a catch 22 though because potential retailers are probably saying, “we need more residents downtown before we invest.” An additional challenge for all of the Mishawaka developers would be that homes/townhomes/condos do not really sell well over $300,000 in this area. The townhomes near Notre Dame sell over $300,000 because people from out of town by them.

At a lower price point, lets use New London Lakes and Oak Hill for a comparison. Oak Hill units of similar size and quality sell for 30-50% more than New London lake units because New London Lake association rules essentially will not allow college students to live there. I know someone who lives in New London Lake and complex is exceptionally quiet in addition to being extremely well maintained by a full time staff of two. Out of town parents effectively bid up the prices on Oak Hill because it has the appearance of being inexpensive.

I will always remember an MBA student telling me he moved into Main Street Village Apartments, the most expensive apartment complex in the area, because prices seemed cheap relative to the $3,200 per month studio he was accustomed to paying for in San Francisco.

JL – Good post. I agree that Oak Hill got bid up by out of towners. New London Lake (singular) is well run and maintained nicely for its age….not sure about the new roof color though. Pretty much most units are gut jobs it you want the feel of newer construction….original 70’s yellow appliance still work apparently. NLL is quiet and few sales. With respect to Oak Hill, there are no bidding wars now and the current owners that are trying to sell have mostly anchored their prices since they overpaid…..the result, no sales…good luck with that. The rents are decent though even if not “cheap”. I don’t think offices would have worked on Ironwood adjacent to Woodbridge. The villas are nice, but need to be sub $150K to spark real interest. With the incredible destruction of wealth in housing and stocks, one wonders how interested HNWI ND people are with owning rarely used real estate that declines in value and costs money each month….. It was a no brainer when prices were going up since simply owner the title of a piece of real estate made you wealthier. Now the reverse is true. I personally think it will take 7-10 years to absorb the units being built. We’ll see.