In Indiana, foreclosures “happen” through a sheriff’s sale. It’s a public auction and proceeds are paid to the property’s lienholders. The sales prices rarely cover the judgment to the bank holding the property’s first mortgage, so all proceeds commonly go to that bank only. In those cases, the sale generally clears the other liens on the property so it can be sold.

In St. Joseph County 90 – 95% of the sales are “won” by attorneys bidding for the banks holding the first mortgage. These aren’t “sales” in the common sense of the word. When the lienholding bank wins the auction, they essentially buy the property from themselves. The bank’s attorney pays the sheriff, who pays the money back to the bank as first lienholder. It’s a dance to scrub the other liens.

Given that, sheriff’s sale are a convenient way to track the number of foreclosures in an area, but a poor way to see what they sell for when they leave the bank’s hands.

In St. Joseph County, the Sheriff’s Department has sold more than 8,500 properties at its weekly sheriff’s sale over the last six years.

Here is the breakdown of the numbers, provided by the Sheriff’s Department:

| Year | Number of Sales |

| 2014 | 926 |

| 2013 | 1,429 |

| 2012 | 1,418 |

| 2011 | 1,165 |

| 2010 | 1,572 |

| 2009 | 2,004 |

8,514 foreclosures. For context, there were 18,282 residential sales in St. Joseph County in the MLS in that same time period. While there is considerable overlap, the numbers make the point: foreclosures have been a significant part of our market.

Foreclosures have a community wide impact. Obviously the occupants and neighbors, but other homebuyers and sellers, landlords, investors, city departments, schools all feel them. And the only information the sheriff’s department has available is the count above. It’s remarkable that there isn’t more data on it.

Indiana is a public disclosure state for sales prices, so it’s possible to recreate much of this data. Skipping through the details, by identifying 75+ variants of “St. Joseph County Sheriff” as the seller, I’ve compiled specifics on almost 5,000 foreclosures. While that’s not comprehensive, it’s a “good enough” to way to further investigate them as a group.

And I used it to tackle a question I’ve had for a while, “What’s the final outcome of these properties, especially those that sell at a very low price? Are they fixed and sold? Rented? Demolished? Do they sit empty for years?”

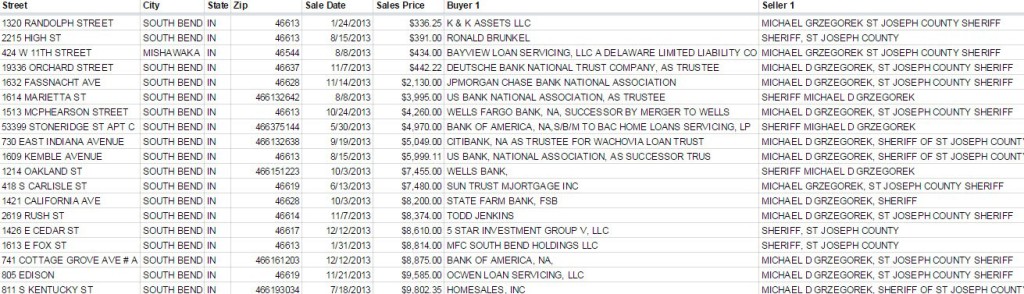

To tackle it, I broke out the 19 foreclosure sales I found under $10k for 2013.

And researched them using the MLS and public records sites and making a few educated guesses. As near as I can tell and with fair confidence, it appears that 1-2 years after foreclosure,

- Five are owner occupied

- Four are listed for sale now with Realtors in the MLS

- Four are investor owned

- Three were donated to Habitat for Humanity

- Three are bank owned and not listed for sale

I find this encouraging. I had suspected most were not financially viable rehab projects. If half or more of the foreclosed homes in the worst shape can be recycled into homes people want to live in, that is a positive indicator for the impacted cities and neighborhoods, even if it’s a slow process getting them back into use.