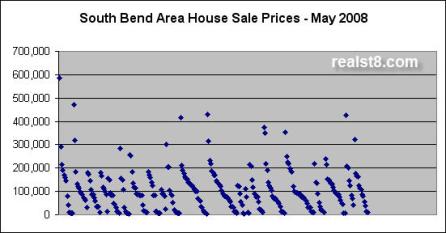

Here’s the May 2008 market report for real estate in the South Bend, Mishawaka, Granger, Notre Dame region. Check back later this month for more analysis of the Note Dame condo market and specific neighborhoods.

Entire MLS (residential)

Listed today: 2,759 properties / combined list price of $400,671,399

Sold in May: 305 transactions / $33,689,009 in volume

Noteworthy: 367 of the 2,759 active listings are priced above $250,000. That’s just 13% of the total. 24 of May’s 305 sales were priced above $250,000. That’s 8% of the total. The South Bend Area has about a 15 month supply of homes in the $250,000+ price range.

Single Family Houses

Listed today: 2,573 properties, combined list price of $360,447,680.

Sold in May: 286 transactions, $29,779,834 in volume.

Townhouses/Condos/Villas

Listed today: 186 properties, combined list price of $40,223,719

Sold in May: 19 transactions, $3,909,175 in volume.

Always interesting to see what it happening. I had recently heard some interesting information with one ND area project doing very well, the numbers were surprisingly high making it probably the best performing upper end development in the county.

Yikes. Those $250,000+ numbers are very concerning. I’m not sure what to make out of them.

It can’t be explained by the rise in Jumbo interest rates. Those are only for loans of $417,000 and up. I would think that most of the homes in South Bend over $250,000 would still be less than $450,000.

There have been a lot of job losses in the area lately. But most of them (at least the ones the media covers) have been blue collar jobs. They may pay fairly well, but I don’t think many of those people would be trying to sell $250,000+ homes.

I can only think of a few potential reasons:

1. People looking to move to South Bend from other areas cannot sell their homes for what they think they should get. (Still living in 2005.) So they don’t move here at all or just get an apartment until their house sells.

2. The increase in gas prices is making people rethink the idea of living in the suburbs. They could live in a smaller, cheaper home closer to work and possibly even ride their bike there. I could especially see this being true of many ND professors. They tend to be a lot more liberal than the typical South Bend resident and more concerned with their “carbon footprint” and that sort of thing.

3. The national downturn in housing prices has affected the mindset of buyers in general. People aren’t so sure that housing is a great investment. So the young couple might be content to stay in their $140,000 3 bedroom ranch instead of trading up for the $250,000 4 bedroom 2 story. Or maybe the young couple would like to trade up, but can’t sell their 3 bedroom ranch because renters are happy to rent and don’t feel that they are going to miss out on appreciation any time soon.

As always, thanks for the informative post.